Consumer Analysis and Marketing Strategy

Video Overview

Quick Navigation

- The “Market Parallax” Model

- Consumer Behaviour Research & Analysis

- Download the Market Parallax Info-Book

- Consumer-Customer Analysis Process

- Identifying Consumers-Customers

- Concept of the Market and its Categories

- Market Segmentation Overview: Unlocking Business Success

- Market Segmentation Process

- Bases for Market Segmentation

- The “DMDES” Framework

- Marketing Funnel & Consumer Journey

- The “Symbiotic Odyssey” Framework

- Market Segmentation Essence

- Segmentation Strategies

- Market Segmentation example #1

- Customer Value

- Measuring Product Value

- Unique Value Propositions (UVPs)

- Current and Potential Market Segments

- Sales Forecast

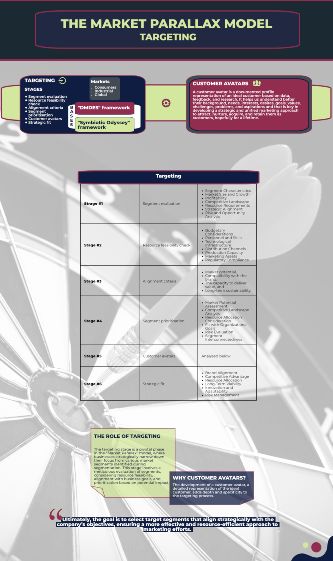

- Targeting

- Segment Evaluation

- Resource Feasibility Check

- Alignment Criteria

- Segment Prioritisation

- Customer Avatars

- Strategic Fit

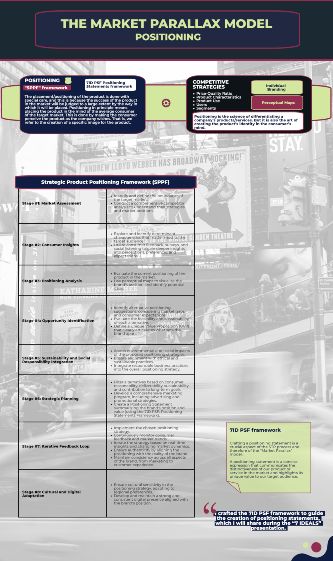

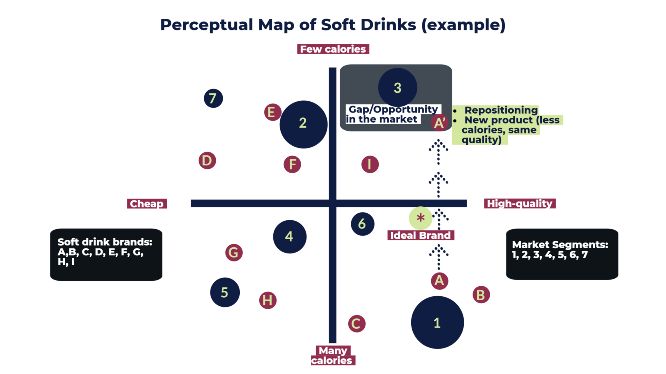

- Product Positioning

- The Product Positioning Process

- Consumer Perception

- Attitudes

- Influences

- Consumer and Public Policy

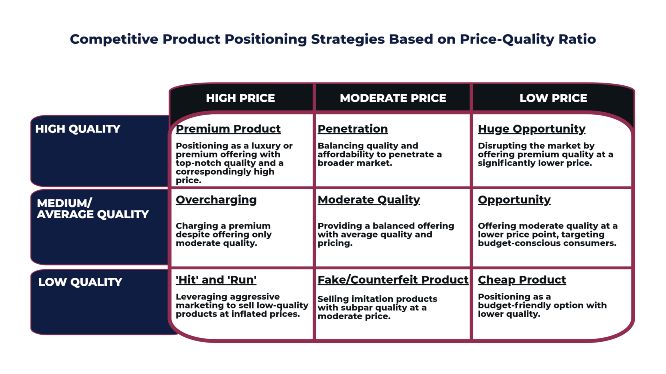

- Competitive Product Positioning Strategies

- Product Positioning and Individual Branding

- Product Positioning Fails

- Marketing Communications & Advertising

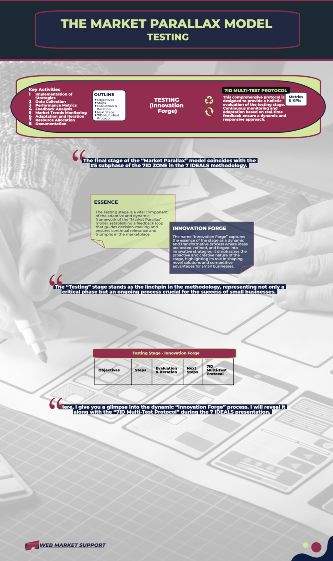

- Testing (Innovation Forge)

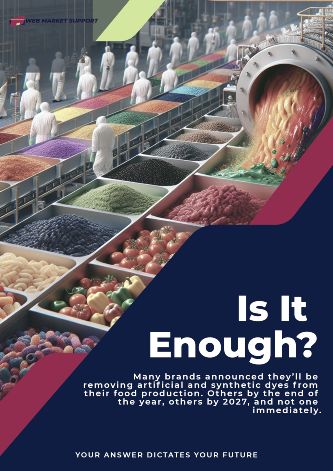

- Trends

- Conclusion: Mastering the Consumer Symphony

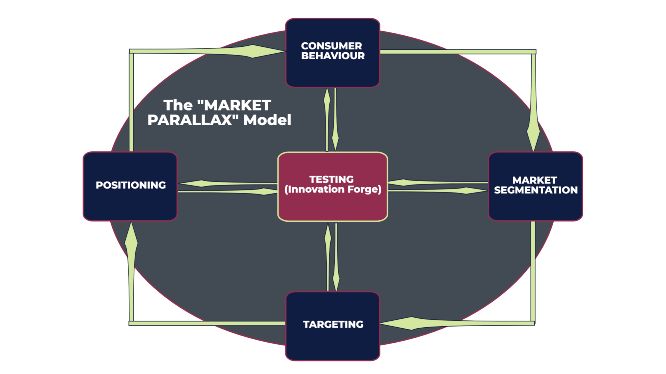

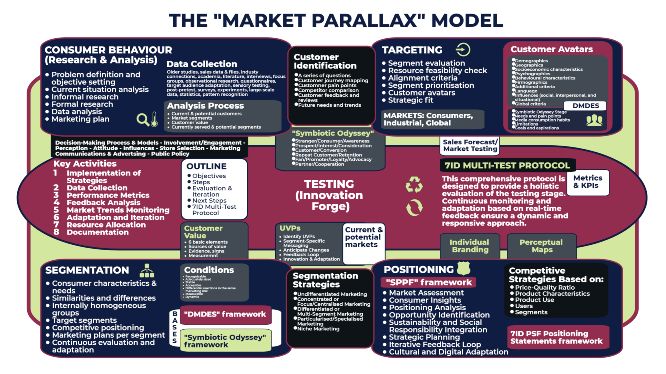

Enter the “Market Parallax” Model

Navigating the Dynamic Landscape of Consumer Engagement

In the complicated collage of marketing strategy, the “Market Parallax” model emerges as a dynamic framework designed to navigate the diverse landscape of consumer engagement. Comprising five pivotal stages, this model harnesses the power of comprehensive research, precise segmentation, targeted strategies, strategic positioning, and rigorous testing. Let’s embark on a journey through each stage:

#1 Consumer Behaviour (Research and Analysis):

- Unveiling Insights: The expedition commences with an in-depth exploration of consumer behaviour, an intricate mix of preferences, motivations, and interactions.

- Data-Driven Understanding: Rigorous research and analysis unravel the nuances of consumer choices, providing a foundation for informed decision-making.

#2 Segmentation:

- Crafting Distinctive Boundaries: Like skilled cartographers, businesses delineate the market landscape into distinct segments based on shared characteristics, needs, and behaviours.

- Tailoring Strategies: Segmentation sets the stage for tailored strategies, ensuring that marketing efforts resonate authentically with each identified segment.

#3 Targeting:

- Precision in Focus: Armed with segmented insights, businesses set their sights on specific target segments, honing in with precision on those most aligned with strategic objectives.

- Strategic Alignment: Targeting unfolds as a strategic dance, where marketing efforts align harmoniously with the unique rhythms of each selected segment.

#4 Positioning:

- Strategic Alignment: The next destination in the “Market Parallax” odyssey is positioning, where businesses strategically place themselves in the consumer’s perception.

- Creating Impact: Positioning is an art of influence, shaping how consumers perceive a brand, product, or service in the broader market panorama.

#5 Testing:

- Refining Strategies: In the crucible of testing, strategies undergo meticulous scrutiny, allowing businesses to gauge effectiveness, adapt swiftly, and optimize for maximum impact.

- Iterative Enhancement: Meticulous testing becomes a compass, guiding businesses on an iterative journey toward marketing excellence and continuous improvement.

In the realm of “Market Parallax,” businesses embrace a wide-ranging, all-encompassing view of the market, leveraging insights, strategies, and testing to position themselves with impact. This model, with its multi-dimensional approach, serves as a guide for businesses seeking not just to navigate the market but to carve a distinct and resonant presence within it.

The “Market Parallax” model is not merely a roadmap; it is an expedition, a dynamic and exploratory journey toward marketing superiority.

In the evolution of strategic marketing, the ‘Market Parallax’ model emerges as a groundbreaking enhancement to the classic Segmentation, Targeting, and Positioning (STP) framework.

The STP model was not created by a single individual but evolved as a marketing framework over time. It is widely attributed to the marketing expert and academic Philip Kotler in 1969. The STP model became a fundamental concept in marketing strategy and is used by businesses to understand and engage with their target audience more effectively. It represents the transition from product-centered marketing to a consumer-focused approach.

Where the traditional STP model may have provided a static lens, ‘Market Parallax’ introduces a dynamic, adaptive perspective that transcends the boundaries of conventional strategy.

By incorporating rigorous consumer behaviour research, precise segmentation, targeted strategies, prudent positioning, and iterative testing, ‘Market Parallax’ transforms the static into the dynamic.

This evolution equips businesses not merely to navigate the market currents but to produce art with its changing rhythms. In the ‘Market Parallax,’ adaptability becomes more than a feature; it becomes the essence, ensuring businesses respond dynamically to the ever-shifting landscape of consumer preferences.

The result is not just strategic marketing; it’s a symphony of adaptability and resonance that defines a new era in consumer engagement.”

| The "Market Parallax" Model Overview | ||||

| Stage #1 | Consumer Behaviour (research and analysis) | |||

| Stage #2 | Segmentation | |||

| Stage #3 | Targeting | |||

| Stage #4 | Positioning | |||

| Stage #5 | Testing | |||

In the “7 IDEALS” methodology, the ‘Market Parallax’ model is not just a stage; it’s a dynamic force that’s always in action. From the initial spark of an idea in business validation, we initiate a perpetual cycle of consumer research, market segmentation, targeted strategies, product positioning, and continuous testing. This model seamlessly collaborates with other frameworks, forming a holistic approach. The ceaseless loop ensures our business evolves, adeptly navigates market shifts, and consistently meets the ever-changing needs of consumers.

In simple terms, the “Market Parallax” model is like a roadmap that helps small business owners navigate the complex world of marketing.

It’s a step-by-step guide that shows you how to understand your customers, find the right audience for your products, and make your business stand out.

It’s not just about selling; it’s about building relationships and making sure your business is always heading in the right direction. With the “Market Parallax” model, you have a tool to make informed decisions, adapt to changes, and create a brand that people love.

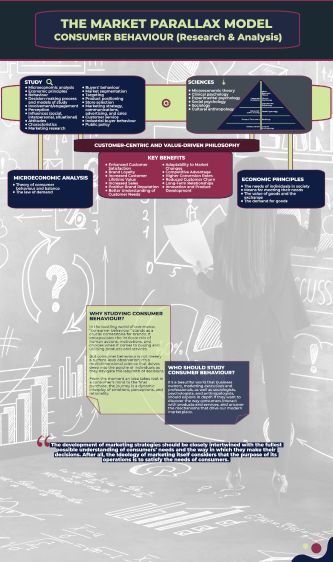

Consumer Behaviour Research & Analysis

Consumer behaviour research is part of marketing research and a clear distinction is made between qualitative and quantitative research (see also previous article regarding consumer behaviour: Consumer Perception and Marketing Strategy).

Consumer Behaviour Research & Analysis Process

An easy way to organize the research process around a consumer behaviour issue is to divide the process into 6 stages:

| Consumer Behaviour Research & Analysis Process | ||||

| Stage #1 | Problem definition and objective setting | |||

| Stage #2 | Current situation analysis | |||

| Stage #3 | Informal research | |||

| Stage #4 | Formal research | |||

| Stage #5 | Data analysis | |||

| Stage #6 | Marketing plan | |||

Problem Definition and Objective Setting

Data Collection & Significance

IMPORTANT DISTINCTION: Here, we research the market with a focus on consumers, but at the same time, we want to monitor our competitors and improve our own business model. We’re analysing competitive activity throughout the first phase of the methodology (7ID ZONE). The “Market Parallax” model collaborates with other models and frameworks during the first 5 subphases of the 7ID ZONE, like the X-Mark, SWOT, 7ID BMCF, Marketing Mix (7 Ps), and 7ID Multi-Test Protocol (phases 1 to 5 are run parallel). Researching the market and performing tests throughout this stage is crucial because it gives us direction as we gather responses from consumers in real-time, feeding the ongoing process with valuable data so we can deliver offerings that people simply can’t resist. On top of that, we do not invest heavily upfront in time, money, and resources to develop products while we minimize risks. When there is enough evidence that things are going to work in our favour, we move on to the 6th subphase – IDEAL ZONE.

That’s the real power of thoughtful research.

Examples of Brands

Numerous smaller brands have successfully utilized informal research methods such as interviews, focus groups, and observational research to refine their positioning. For example:

- Warby Parker (Eyewear): Warby Parker, a direct-to-consumer eyewear brand, engaged in conversations with potential customers through surveys and interviews. By understanding consumer pain points related to high eyewear prices, the company positioned itself as an affordable and stylish alternative to traditional eyewear retailers.

- Dollar Shave Club (Personal Care): Before launching, Dollar Shave Club conducted informal interviews and observed consumer behaviours related to razor purchasing. This research revealed dissatisfaction with expensive razors, leading Dollar Shave Club to position itself as a subscription-based service providing affordable and convenient shaving solutions.

- TOMS (Footwear): TOMS, known for its “One for One” model, initially positioned itself by understanding the social consciousness of consumers. Through informal research, TOMS identified a desire among consumers to make a positive impact through their purchases. This insight helped position TOMS as a socially responsible brand, donating a pair of shoes for every pair sold.

These examples highlight how informal research methods can contribute to successful brand positioning by aligning products or services with consumer needs and values. By listening to their target audience, these brands were able to create authentic and resonant brand messages.

Examples of Brands

Several non-giant brands have conducted experiments (formal research) to inform their positioning and achieve success. Here are a few examples:

- Mailchimp (Email Marketing): Mailchimp, a marketing automation platform, has been known for its data-driven approach. The company regularly conducts A/B testing on its website, emails, and various features. Through experiments, Mailchimp refines its user interface, messaging, and user experience, positioning itself as a user-friendly and effective marketing tool for businesses of all sizes.

- Casper (Mattresses): Casper, a mattress-in-a-box company, conducted extensive research, including sleep studies and surveys, to understand consumer preferences in the mattress industry. By combining formal research with product innovation, Casper positioned itself as a brand that offers high-quality mattresses tailored to the needs of modern consumers.

- Everlane (Fashion): Everlane, a clothing retailer, is known for its commitment to transparency. The company has experimented with transparent pricing and supply chain information, allowing customers to see the true cost of each product. This experiment aligns with Everlane’s positioning as an ethical and transparent fashion brand.

- HelloFresh (Meal Kit Delivery): HelloFresh, a meal kit delivery service, relies on data and experimentation to optimize its meal offerings, delivery options, and user experience. By conducting formal research and experiments, HelloFresh positions itself as a convenient and customizable solution for individuals and families seeking meal planning assistance.

These examples illustrate how brands leverage formal research and experiments to refine their positioning, enhance customer experience, and align their offerings with consumer preferences.

Document Findings and Insights: Keep detailed records of all research findings, insights, and observations. Organize data in a systematic manner to facilitate analysis and decision-making throughout the research process.

Conduct Experiments and Market Testing: Design experiments and market testing initiatives to validate hypotheses and business ideas, assess demand, and evaluate the feasibility and viability of products and services before the development phase. Utilize the 7ID Multi-Test Protocol (see below) to gather actionable insights and refine your offerings based on real-world feedback.

By following these steps and leveraging a combination of formal and informal research methods, you’ll be able to gain deep insights into consumer behavior, identify emerging trends, and uncover valuable opportunities for your business.

In stage #5 Data analysis, the data collected in the previous stages are analyzed here with a view to testing hypotheses that were formulated before data collection. This analysis should lead to specific conclusions as well as general suggestions that will be useful in the next and final stage of the process which is the marketing plan.

The data analysis stage involves the application of statistical tools and techniques to draw meaningful conclusions from the collected data. Additionally, pattern recognition processes, often associated with data mining and machine learning, help identify hidden patterns, trends, or associations within the data. Here’s an overview:

Statistical Tools and Techniques:

Descriptive Statistics:

- Measures of Central Tendency: Mean, Median, Mode.

- Measures of Dispersion: Range, Variance, Standard Deviation.

- Frequency Distributions: Displaying the distribution of data.

Inferential Statistics:

- Hypothesis Testing: Assessing the significance of observed differences or relationships.

- Regression Analysis: Examining the relationship between dependent and independent variables.

- Analysis of Variance (ANOVA): Comparing means across multiple groups.

- Chi-Square Tests: Analyzing relationships in categorical data.

Correlation and Regression:

- Correlation Analysis: Examining the strength and direction of relationships between variables.

- Regression Analysis: Modeling the relationship between a dependent variable and one or more independent variables.

Predictive Modelling:

- Machine Learning Algorithms: Utilizing algorithms for prediction, classification, or clustering.

- Decision Trees, Random Forests, and Support Vector Machines: Common techniques for predictive modelling.

Factor Analysis and Cluster Analysis:

- Factor Analysis: Identifying underlying factors influencing observed variables.

- Cluster Analysis: Grouping similar data points based on defined criteria.

Time Series Analysis:

- Trend Analysis: Identifying patterns and trends over time.

- Seasonal Decomposition: Separating data into components like trend, seasonality, and noise.

Pattern Recognition Process:

Data Preprocessing:

- Data Cleaning: Handling missing values, outliers, and errors.

- Normalization and Scaling: Ensuring consistency in variable scales.

Feature Selection:

- Identifying Relevant Features: Selecting variables that contribute significantly to the analysis.

- Dimensionality Reduction: Reducing the number of features for simplicity and efficiency.

Model Training:

- Supervised Learning: Training models using labelled data for prediction tasks.

- Unsupervised Learning: Discovering patterns and relationships without labelled data.

Evaluation and Validation:

- Cross-Validation: Assessing model performance on different subsets of the data.

- Metrics: Using appropriate evaluation metrics based on the nature of the analysis (accuracy, precision, recall, etc.).

Interpretation and Visualization:

- Visualizing Results: Creating charts, graphs, or plots to communicate findings.

- Interpreting Patterns: Understanding the significance of identified patterns in the context of the research question.

Iterative Refinement:

- Model Adjustment: Refining models based on feedback, improving predictive accuracy.

- Feedback Loop: Iterating the analysis to enhance insights and address limitations.

The combination of statistical analysis and pattern recognition allows researchers to uncover actionable insights, make informed decisions, and develop strategies for the marketing plan. It’s crucial to choose appropriate techniques based on the nature of the data and research objectives.

In stage #6 marketing plan, the development of a marketing plan is essentially what we are interested in extracting from the whole process that preceded it. That is, we are not simply interested in knowing how consumers think, how they act, how they decide, but above all we are interested in all this in relation to what it entails in terms of marketing operations.

If we know all of the above, we are able to discover the most appropriate way to approach the consumer, which consumer, and so on.

In the marketing plan, for example, we will identify based on the analysis the various market segments, select one or more of them as target markets, and approach each of them individually with a separate marketing plan, formulating strategies and programs that they will address each element of the marketing mix.

In essence, the purpose of the marketing plan is to translate the insights gained from consumer behaviour research into actionable strategies and programs (tactics).

The marketing plan is a dynamic document that should evolve alongside changes in consumer behaviour, market conditions, and competitive landscapes. It serves as a roadmap for the organization to effectively connect with its target consumers and achieve sustainable success.

You can download the book inside the “Business Growth Hub” membership. Register a FREE account and you will receive a password to get access to the membership area (guides, eBooks, exclusive content and workshops, exclusive services, and more).

The Consumer-Customer Analysis Process

Consumer analysis typically follows consumer behaviour research. Consumer behaviour research involves the systematic study of consumers’ actions, preferences, motivations, and decision-making processes. Once this research is conducted and data is gathered, the next step is to analyze the information to derive meaningful insights into consumer patterns, needs, and behaviours.

Consumer analysis involves interpreting the collected data, identifying trends, segmenting the target audience, and gaining a deeper understanding of the factors influencing consumer choices. It’s a crucial phase in formulating effective marketing strategies and tailoring products or services to meet consumer demands.

The consumer-customer analysis process includes the following stages:

#1 Identification of Current and Potential Customers-Consumers:

- Explore customer demographics, psychographics, and behavioural patterns.

- Assess the needs and preferences of current and potential customers.

- It’s crucial to understand who the existing customers are and to explore opportunities for expanding the customer base.

#2 Description of Market Segments (Groups of Consumers):

- Dig deeper into the characteristics that define each market segment.

- Consider lifestyle factors, preferences, and cultural influences.

- Segmenting the market allows for a more targeted and personalized approach to marketing. Describing different market segments helps in tailoring strategies to the specific needs, preferences, and behaviours of distinct consumer groups.

#3 Identification of Product Value Bases for the Consumer (Customer Value) by Market Segment, and Possible Changes in These Bases in the Future:

- Understanding the value that products or services offer to consumers within each market segment is essential. This stage involves identifying the unique value propositions for different segments and anticipating how these value bases might evolve over time.

#4 Description of the Market Segments That the Company Currently Serves, the Ways in Which It Serves Them, as Well as a Description of Its Potential Customers:

- This stage provides an overview of the company’s current market presence, including the market segments it serves and the effectiveness of the strategies employed to cater to them. Additionally, identifying opportunities for expansion and understanding potential customers helps in strategic planning and business growth.

By progressing through these stages, our organization can gain valuable insights into the consumer landscape, enabling us to make informed decisions about product development, marketing strategies, and overall business direction. This process supports a customer-centric approach, ensuring that products and services align with the needs and expectations of the target audience.

| Consumer-Customer Analysis Process | ||||

| Stage #1 | Identification of current and potential customers | |||

| Stage #2 | Description of market segments (groups of consumers) | |||

| Stage #3 | Customer value by market segment and possible changes | |||

| Stage #4 | Currently served market segments and potential segments | |||

Identifying Consumers-Customers

Identifying our company’s customers requires answers to:

A Series of Questions:

- Who are they? Their description according to the relevant segment of the market, to which they belong, using for segmentation criteria the known variables (e.g. for consumer products: demographic, psychographic, and socioeconomic characteristics, etc., and for industrial products: SIC code, customer size, location, behaviour, etc.).

- What do consumers buy? What do they do with the product? How do they use it?

- Where do they usually shop for it? Where do they buy it from?

- When do they buy it?

- How do they buy it? (ie, how do they choose it, what quantities do they buy, and on what terms? and so on)

- Why do they buy it? What is the value of the product for the consumer? Value can be defined based on the basic need or desire satisfied by the use of the product, or based on the benefit derived for the consumer from its use.

Customer Journey Mapping:

- How do customers typically become aware of our products or services?

- What channels or touchpoints do they interact with during their decision-making process?

Customer Pain Points:

- What challenges or issues do customers face that our products or services can address?

- Are there common pain points in the customer journey that we can alleviate?

Competitor Comparison:

- How do our customers perceive our products/services compared to those of our competitors?

- What unique value propositions or features set us apart?

Customer Feedback and Reviews:

- What are customers saying about our products or services in reviews or feedback?

- Are there recurring themes or suggestions that could guide improvements?

Future Needs and Trends:

- Are there emerging trends or shifts in consumer behaviour that might impact our offerings?

- How can we anticipate and adapt to future needs?

This process provides a holistic view of customer identification, incorporating insights from their journey, experiences, and evolving expectations.

| Identification of current and potential customers | ||||

| A series of questions | Who (criteria), what, when, where, why, how, value | |||

| Customer journey mapping | Awareness, channels, touchpoints | |||

| Customner pain points | Challenges, issues, problems, commonalities | |||

| Competitor comparison | Perceptions, UVP, features | |||

| Customer feedback and reviews | Careful analysis, reccuring themes or suggestions | |||

| Future needs and trends | Emerging shifts, anticipation, adaption | |||

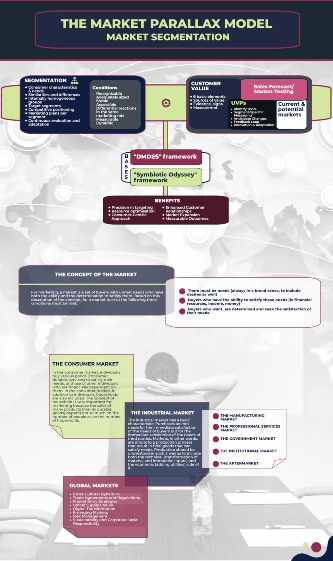

Concept of the Market and its Categories

The word market, depending on the specific context in which it is used, has different meanings. We say, for example, the market of Athena Street, the market of Cyprus. In this case, the market refers to a specific geographic area. In other cases, we say that the oil market or the gold market is declining. In these cases, the market refers to a specific product. When the consumer says that they went to the market, they mean that they went to where the shops/stores are, i.e. the supply. When they again say that the market of X product was difficult for them, they mean that the conditions of the offer (for example, price, location, availability, product, payment terms, behaviour of sellers, and service in the store) were not what they expected to be.

For marketing, a market is a set of buyers with unmet needs who have both the ability and the determination to satisfy them. Based on this description of the concept, for a market to exist the following three conditions must be met:

- There must be needs (always in a broad sense, to include desires as well)

- Buyers who have the ability to satisfy these needs (ie financial resources, income, money)

- Buyers who want, are determined and seek the satisfaction of their needs.

As needs, capabilities and determination increase, so does market size, which for marketing means increased market potential and sales potential. Needs increase when the number of buyers increases (with the needs of each of them unchanged), when those needs themselves increase (with the number of buyers unchanged), or, and this is the most common case, when both increase. The ability to satisfy needs increases when the income of buyers increases. Finally, determination increases when the propensity to spend income increases. The size of the market affects not only the size of the production and, therefore marketing, but also the cost of production.

The market is divided into several categories depending on who the buyer is:

- Consumer market

- Industrial market (manufacturing, professional services, government, institutional, aftermarket), and

- Global market

In the consumer market, individuals buy various goods (consumer, durable, services) to satisfy their needs, or those of other individuals who are financially dependent on them. In the consumer market, in addition to individuals, households are also included. The concept of household is very important for marketing because the sales of many products (mainly durable goods) depend not so much on the number of people as on the number of households.

The industrial market has a basic characteristic: Purchases are not made for the immediate satisfaction of the needs of buyers but for the immediate satisfaction of the needs of third parties. Markets, in other words, are inputs to a production process that result in final goods that can satisfy needs. Production should be understood in such a way as to include both the technical (transformation of material and immaterial inputs) and the economic (adding utilities) side of it.

In the manufacturing market, buyers are industries, crafts, agricultural units, service units (electricity, telecommunications, water supply, banks, etc.) and others. The products they purchase include, but are not limited to, raw materials, semi-finished materials, capital goods, product parts, and miscellaneous supplies.

The professional services market encompasses businesses and entities that primarily offer services rather than tangible goods. Services often have distinct characteristics and may require specific segmentation criteria. Here are some factors we consider: nature of services, delivery models, specialisation, geographic focus, technology integration, customer relationship dynamics, and regulatory compliance.

In the government market, the buyer is the state, local government, and other legal entities under public law. Tendering (with sealed or open bids) is the dominant purchasing process. This process includes the following steps:

- Identification of needs

- Programming their satisfaction

- Detailed definition of the specifications (ie the technical characteristics) of the products to be purchased

- Wide publication of these specifications, competition

- Accepting offers from various suppliers

- Evaluation – selection of an offer

- Signing a supply contract

- Receipt and control of the products

In the institutional market, buyers are various institutions with a charitable mission, such as hospitals, nursing homes, churches, museums, sports clubs, trade unions, foundations, committees, and others. All these institutions have clearly defined goals that they are trying to achieve, free from the profit motive.

Finally, in the aftermarket – resale market, buyers are the intermediaries of the distribution channels, and mainly the wholesalers and retailers. These intermediaries buy the products to resell them as is, for a profit. The very few exceptions (for example packaging in smaller units of volume or weight) do not overturn the rule, namely that intermediaries do not bring about any change in the technical characteristics of the products they resell. Instead of the utility of production, intermediaries produce the utilities of place, time and possession.

In contrast to the consumer market, the industrial market is characterized by the geographical concentration of buyers (the great majority of them are in certain areas), the adoption of rational selection criteria for the products they buy (the economic model basically interprets their buying behaviour), and from collective or multi-person decision making for purchase (for example committees).

In the realm of global markets, businesses transcend geographical boundaries to engage in cross-border transactions and address the diverse needs of consumers worldwide. This category encapsulates the complexities and opportunities presented by the interconnected global economy. Here are key aspects to consider:

- Cross-Cultural Dynamics: Global markets necessitate an understanding of diverse cultures, languages, and consumer behaviours. Effective marketing requires cultural sensitivity and the ability to tailor strategies to resonate with audiences from different backgrounds.

- Trade Agreements and Regulations: Businesses operating in global markets must navigate international trade agreements, tariffs, and regulations. These factors significantly impact the feasibility and cost-effectiveness of conducting business across borders.

- Market Entry Strategies: Companies entering global markets face critical decisions regarding market entry strategies. Choices range from exporting and licensing to establishing joint ventures or wholly-owned subsidiaries. Each approach comes with its own set of challenges and considerations.

- Global Supply Chains: The dynamics of global markets extend to supply chain management. Businesses must optimize their supply chains for efficiency, resilience, and sustainability, considering factors like transportation, logistics, and geopolitical risks.

- Digital Transformation: The advent of digital technologies has transformed global marketing. Digital advertising, eCommerce, and social media play pivotal roles in reaching a global audience. Businesses need to embrace digital strategies to stay competitive on the global stage.

- Emerging Markets: Beyond established economies, emerging markets present new opportunities. These regions often undergo rapid economic development, offering potential for market expansion. Understanding the unique characteristics of these markets is crucial for success.

- Risk Management: Global markets introduce additional risks, including currency fluctuations, political instability, and cultural misunderstandings. Robust risk management strategies are essential for mitigating potential challenges and ensuring long-term sustainability.

- Sustainability and Corporate Social Responsibility: Global consumers increasingly prioritize sustainable and socially responsible practices. Businesses operating in global markets need to align with these values, incorporating sustainability into their strategies to enhance brand reputation.

Incorporating the dynamics of global markets into our market framework acknowledges the evolving nature of business in an interconnected world and provides a comprehensive perspective for marketers aiming to navigate the complexities of the global stage.

Market Segmentation Overview: Unlocking Business Success

We analyzed that one of the most basic rules for business success is targeting the right people. Our target audience. Those people that we know are interested in our products, services, solutions, and offers.

Why? Even the best products in the world can’t be sold if we reach out to people with little or no interest. We’ll be wasting time, resources, and money.

Not all buyers are the same, everyone perceives the products differently and analyzes them according to their own standards and beliefs. Also, not all buyers have the same needs nor the same resources to meet their needs.

All the above findings lead us to segment the market into individual segments (subsets).

For marketing to bring about positive results, it should first define its goals and then strive to achieve them. The more precisely the goal is defined, the easier it is to achieve it. If all this does not happen, not only is success a matter of luck but also the waste of resources is inevitable. By segmenting and then targeting consumers effectively, who are the primary target of any business, we set the base for ongoing success and expansion.

Market segmentation is a strategic approach that involves dividing a diverse market into distinct and manageable segments based on shared characteristics, needs, or behaviours, the calculation of their size, the understanding of how consumer needs are met, and the effort to satisfy them with the appropriate marketing mix.

This practice holds immense significance for businesses striving to achieve targeted marketing goals and sustained success. Here’s why market segmentation is a cornerstone of effective business strategy:

Precision in Targeting:

- Defined Goals: Market segmentation allows businesses to clearly define their marketing goals, fostering a targeted and purposeful approach.

- Strategic Alignment: Precise segmentation ensures marketing efforts align strategically with specific consumer needs and preferences.

Resource Optimization:

- Efficient Resource Allocation: By identifying and prioritizing high-potential segments, businesses can optimize resource allocation, preventing waste and maximizing returns.

- Budget Efficiency: Targeting specific segments reduces the risk of spreading marketing efforts too thin, ensuring that resources are invested where they yield the most impact.

Consumer-Centric Approach:

- Understanding Diversity: Segmentation acknowledges the diversity within a market, recognizing that consumers have unique characteristics, behaviours, and preferences.

- Tailored Strategies: Businesses can craft tailored marketing strategies that resonate with the specific needs and desires of each segment, enhancing consumer engagement.

Enhanced Customer Relationships:

- Personalization: Segmentation facilitates personalized interactions with consumers, strengthening the bond between the brand and its audience.

- Repeat Business: By addressing the distinct requirements of each segment, businesses can foster customer loyalty and encourage repeat business.

Market Expansion:

- Identifying Opportunities: Segmentation unveils new opportunities within a market, allowing businesses to discover untapped segments with growth potential.

- Adaptability: As markets evolve, segmented strategies enable businesses to adapt swiftly to changing consumer trends and behaviours.

Measurable Outcomes:

- Performance Metrics: Well-defined segments provide clear criteria for measuring the success of marketing initiatives, enabling data-driven decision-making.

- Continuous Improvement: Metrics derived from segmented strategies guide businesses in refining their approach for continuous improvement.

In essence, market segmentation is the compass that guides businesses toward their target audience, ensuring that marketing efforts are purposeful, resource-efficient, and deeply connected to consumer needs. By understanding and embracing the diversity within the market, businesses pave the way for sustained success, expansion, and meaningful consumer relationships.

Market Segmentation Process

Market segmentation is a systematic process of identifying internally homogeneous groups of buyers who require different marketing strategies to influence their consumption. Segmentation as an analytical method is linked to marketing strategy through the positioning of the product in the market in relation to the positioning of the competitors.

Before our business proceeds with the segmentation of the market of interest, we should answer two basic questions:

- Is it possible for the conventional market to expand?

- Can the market be segmented?

If the answers to the previous two questions are affirmative, our business can proceed by following the process steps shown in the figure below.

- Systematic Identification of Consumer Characteristics and Needs: Determining the characteristics and needs of consumers for the product category that interests our company. This initial step lays the foundation for effective market segmentation.

- Analysis of Similarities and Differences: Analyzing both similarities and differences among consumers ensures a comprehensive understanding of the market, helping to identify patterns and potential segmentation criteria.

- Development of Internally Homogeneous Groups (Segments): Development of internally homogeneous groups (segments) of consumers and their descriptions (segment profiles). Creating segments based on shared characteristics and needs enables the development of targeted marketing strategies tailored to the unique requirements of each group.

- Selection of Target Segments: The selection of target segments involves prioritizing and choosing segments that align with the company’s objectives and resources.

- Positioning Relative to Competition: Positioning the company’s product relative to competitors is essential for creating a distinctive and competitive market presence.

- Development of Marketing Plans for Each Segment: We develop an appropriate marketing plan and marketing mix for each target segment that ensures a focused and effective approach.

- Continuous Evaluation and Adaptation: We regularly assess the effectiveness of the segmentation strategy. We monitor shifts in consumer behaviour, preferences, and market dynamics. We gather feedback and data to evaluate the performance of each segment. We adapt marketing plans and strategies based on changing circumstances to maintain relevance. This last stage emphasizes the dynamic nature of markets and the need for businesses to stay agile in response to evolving consumer trends and competitive landscapes (if they want to avoid unwanted consequences.

| Market Segmentation Process & Conditions | ||||

| Step #1 | Systematic identification of consumer characteristics and needs | |||

| Step #2 | Analysis of similarities and differences | |||

| Step #3 | Development of internally homogeneous groups (segments) | |||

| Step #4 | Selection of target segments | |||

| Step #5 | Positioning relative to competition | |||

| Step #6 | Development of marketing plans for each segment | |||

| Step #7 | Continuous evaluation and adaptation | |||

| Conditions |

|

|||

For segmentation to be successful, certain conditions must be met. That is, the segments that will result from the analysis must be

- Recognizable – segments can be identified based on their characteristic criteria and it’s fundamental for targeted marketing efforts.

- Adequately sized – large enough to be worth the investment, and to be of interest from a financial point of view. Ensuring that segments are large enough to justify investment is crucial for achieving a positive return on marketing efforts.

- Stable – not changing drastically, at least during the period of implementation of the marketing plan that is essential for consistent and predictable targeting.

- Accessible – Accessibility through various elements of the marketing mix, such as distribution channels, is necessary for effective engagement with the chosen segments.

- Differential Reactions in the Same Marketing Mix – To react differently (one from the rest), in the same marketing mix. This highlights the uniqueness of each segment and underscores the importance of customization.

- Measurable: Segments should be quantifiable and measurable using reliable data and metrics. Measurability allows for an accurate assessment of the size, characteristics, and behaviour of each segment. It facilitates the monitoring of marketing performance and aids in making data-driven decisions. This condition emphasizes the importance of having clear metrics and data points to evaluate the success and efficiency of marketing efforts within each segment.

- Dynamic: We acknowledge that market segments may evolve over time due to shifts in consumer behaviour, preferences, or external factors. Recognizing the dynamic nature of segments ensures that marketing strategies remain adaptable to changes, helping businesses stay ahead of evolving market dynamics.

NOTE: Condition #3 is stable, and condition #7 is dynamic.

Stability regarding condition #3, in this sense, refers to a level of consistency or predictability in the characteristics of the identified segments over the period relevant to the marketing plan’s implementation. It implies that the segmentation variables and criteria used to define segments remain relatively steady, allowing businesses to target and address the needs of those segments with a degree of reliability. It doesn’t necessarily mean that segments should remain entirely unchanged but rather maintain a level of steadiness for effective planning and implementation.

If any of the good segmentation criteria are violated, we should resort to using other basic (characteristic) segmentation criteria, or other combinations of criteria.

This comprehensive approach aligns well with the complexity of markets and the need for nuanced segmentation strategies. This framework provides a solid foundation for businesses seeking to implement effective market segmentation.

Bases for Market Segmentation

Consumer and Industrial Market Segmentation: Recognizing the distinction between consumer and industrial market segmentation is crucial, as the criteria for segmentation can differ based on the nature of the target audience.

Common segmentation bases are presented below, separately for consumer and industrial market segmentation.

The “DMDES” Framework

I crafted a unique framework for market segmentation which I use in the “7 IDEALS” methodology because no framework takes such a holistic approach to dividing markets.

The name “DMDES” is a combination of the words “dynamic”, “market” and “division”, and combines elements of “ecology” and “systems thinking”, conveying the idea of a panoramic, all-inclusive, interconnected and evolving/dynamic approach to market segmentation.

| The "DMDES" Framework (overview) | |

| Consumer Markets | Demographic characteristics |

| Geographic characteristics | |

| Socioeconomic characteristics | |

| Psychographic characteristics | |

| Behavioural characteristics | |

| Industrial Markets | Firmographics |

| Consumer & Industrial Markets | Additional Criteria |

| Language | |

| Social, Interpersonal, and Situational Influences | |

| Global Markets | Global Criteria |

#1 Consumer Markets

Demographic characteristics:

- Age

- Gender

- Household/family size

- Family lifecycle

- Income

- Occupation (employment)

- Education level

- Religion

- Ethnicity

- Origin/race

- Social status

- Marital status

- Place of main residence, etc.

Additional Considerations:

- Longer average life

- Effects of birth cycles and longer life expectancy on future age distribution

- New roles for women

- Increasing economic and educational improvement

- Changes in the structure and composition of households

Geographic characteristics:

- Area (urban, semi-urban, rural)

- Region

- Size of city or village

- Population density (sparse, medium, high)

- Climate (warm, mild, cold, tropical, Mediterranean)

- Terrain formation (plain, semi-mountainous, mountainous, island)

- Standard metropolitan statistical area

- County or district size

- Geographical changes of populations

Socioeconomic characteristics: Social class, lifestyle, cultural background, etc. These characteristics are essential elements of market segmentation, providing insights into the social and economic status of consumers. Here’s an overview of some key socioeconomic characteristics:

- Social Class: Social class is a hierarchical arrangement of individuals or groups within a society based on factors such as income, education, occupation, and lifestyle. Consumers from different social classes often exhibit distinct purchasing behaviours and preferences.

- Lifestyle: Lifestyle encompasses the way individuals live, including their activities, interests, opinions, and values. It influences consumer choices, preferences, and product usage. Lifestyle segmentation helps identify groups with similar patterns of living.

- Cultural Background: Cultural background refers to the shared values, beliefs, customs, and traditions of a particular group or community. Understanding cultural backgrounds is crucial for tailoring marketing messages to resonate with diverse consumer groups.

- Education Level: Education level reflects an individual’s level of formal education. It can influence consumer decision-making, preferences, and the types of products or services they are likely to engage with.

- Occupation: Occupation indicates the type of work individuals are engaged in. Occupational segmentation helps identify professionals, blue-collar workers, entrepreneurs, etc., each with distinct needs and preferences.

- Income: Income is a key socioeconomic factor that directly impacts purchasing power. Consumers with different income levels may have varying priorities, spending patterns, and preferences.

- Family Structure: Family structure includes factors such as household composition, family size, and the roles of family members. These aspects influence buying decisions, with family-oriented marketing strategies targeting specific family structures.

- Social Influence: Social influence refers to the impact of family, friends, and social networks on consumer behaviour. Understanding social influence helps in crafting marketing messages that resonate with interpersonal connections.

- Values and Beliefs: Socioeconomic characteristics also encompass the values and beliefs held by individuals or groups. Aligning products or services with the values of target segments enhances market appeal.

- Leisure Activities: Leisure activities, hobbies, and interests contribute to lifestyle patterns. Segmenting consumers based on their leisure activities helps tailor marketing strategies to specific recreational preferences.

- Digital Engagement: The level of digital engagement, including internet usage, social media participation, and online shopping behaviour, is increasingly becoming a relevant socioeconomic characteristic in the modern era.

Psychographic characteristics: Values, attitudes, interests, personality traits, and lifestyle. Psychographic criteria are obviously more difficult to identify and calculate accurately. The psychological profile of the consumer is defined based on five main axes: a) Motives, b) Needs and Desires, c) Personality, d) Attutudes, and e) Lifestyle.

#1 Motives: Motives typically encompass both rational and emotional aspects:

- Functional Motives: Practical and utilitarian reasons behind consumer choices, such as the need for convenience, efficiency, or specific product features.

- Emotional Motives: Feelings and emotions that influence consumer behaviour, including the desire for pleasure, excitement, security, or social acceptance.

- Social Motives: Motivations arising from social interactions and relationships, such as the need for affiliation, recognition, or belonging.

- Personal Motives: Individual motivations related to personal values, self-expression, and self-improvement.

- Cultural and Psychological Motives: Motivations influenced by cultural norms, values, and psychological factors, including the desire for status, identity, or cultural alignment.

#2 Needs and Desires: A need is a basic requirement of the body, without which life cannot continue. Food, clothing, shelter, and health are examples of needs. On the contrary, desire refers to any non-necessary demand caused by the intended pleasure. Fun, education, and sociability are examples of desires.

I combine 3 theories to investigate needs and desires.

- The Hierarchy of Needs is a psychological theory proposed by Abraham Maslow in the mid-20th century. Maslow’s hierarchy suggests that human needs can be organized into a pyramid, with the most fundamental needs at the base and higher-order needs at the top. Physiological, safety, belongingness and love, esteem, and self-actualisation.

- The “Self-Determination Theory” (SDT) developed by Deci and Ryan posits that individuals have three innate psychological needs: autonomy, competence, and relatedness. It suggests that satisfying these needs leads to enhanced motivation and well-being.

- The “Hierarchy of Effects” model is often used in marketing. It outlines the stages a consumer goes through in making a purchase decision, starting from awareness and ending with action. It has six stages: awareness, knowledge, liking, preference, conviction, and purchase. While it incorporates cognitive, affective, and behavioural components, it doesn’t focus explicitly on needs and desires but provides insights into the stages of consumer decision-making.

The integration of these 3 theories into a comprehensive list of needs and desires has significant implications for marketing:

Physiological Needs (Maslow):

- Health and well-being

- Basic nutrition and hydration

- Shelter and comfort

- Reproduction

Safety and Security (Maslow):

- Financial stability

- Job security

- Personal safety and protection

- Emotional security

Belongingness and Relatedness (Maslow, SDT):

- Family

- Social connections and relationships

- Community involvement

- Feeling part of a group or tribe

- Intimacy

- Trust

- Acceptance

- Love and affection

Esteem and Recognition (Maslow, SDT):

- Recognition and acknowledgement: status, fame, prestige, attention

- Achieving personal goals

- Developing competence and skills

- Strength, self-confidence

Autonomy and Control (SDT):

- Independence and freedom

- Control over life decisions

- Personal empowerment

Competence and Mastery (SDT):

- Opportunities for skill development

- Mastery in areas of interest

- Personal growth and learning

Aesthetic and Self-Actualization (Maslow, Hierarchy of Effects):

- Pursuit of beauty and aesthetics

- Creativity and self-expression

- Pursuing goals

- Fulfillment of personal potential

- Partner acquisition

- Parenting

- Talents and abilities

Cognitive and Information Needs (Hierarchy of Effects):

- Desire for knowledge and information

- Intellectual stimulation

- Cognitive engagement and curiosity

- Foresight

Emotional and Experiential Needs (Hierarchy of Effects):

- Emotional well-being

- Positive experiences and enjoyment

- Novelty and excitement

Transcendence/Spiritual Needs:

- Transcendence: The desire for personal growth, self-realization, and a connection to something beyond oneself. This could include spiritual or philosophical aspects.

- Meaning and Purpose: Seeking a sense of meaning and purpose in life, which can influence choices related to products, services, or experiences.

- Connection to Nature or Environment

- Philanthropy and Social Impact: The desire to contribute to a greater good or make a positive impact on society, aligning with a sense of transcendence.

This list encompasses a broad range of human needs and desires, integrating insights from various psychological theories. It can serve as a foundation for understanding and segmenting consumers based on their psychographic characteristics.

#3 Personality: Each person has their own personality which may differ in some or even several points from the personality of another. Personality is a complex concept and its characteristics (dimensions), based on which it can be studied and evaluated, are many. Leaving aside extreme cases (exceptions), we can study personality and draw valuable conclusions for marketing using the following dimensions:

- Masculinity, femininity

- Independence: It affects, among other things, clothing, food, entertainment, and the way one shops. Fashion and its acceptance or rejection are directly related to this dimension

- Achievement

- Anxiety, concern, nervousness

- Sociability

- Dominance

- Adaptability

- Aggressiveness: testing new products, negotiating prices, and demanding better service

- Seriousness

- Emotion control

- Openness to Experience: This trait reflects a person’s willingness to try new things, engage in novel experiences, and seek variety in life. It can influence preferences in areas such as travel, leisure activities, and product innovation.

- Conscientiousness: This trait pertains to an individual’s level of organization, responsibility, and attention to detail. It can influence preferences in products or services related to organization, reliability, and functionality.

- Optimism/Pessimism: Attitudes toward the future and outlook on life can affect consumer choices, especially in areas related to health, lifestyle, and long-term planning.

- Hedonism: The pursuit of pleasure and enjoyment can influence choices in entertainment, leisure activities, and products associated with enjoyment.

- Spirituality: Beyond transcendence, the specific spiritual beliefs or inclinations of individuals may play a role in their preferences and choices.

#4 Attitudes: Consumer attitudes encompass a wide range of beliefs, opinions, and evaluations that shape their perceptions and behaviours:

- Environmental consciousness: Attitude towards sustainability and eco-friendliness.

- Innovativeness: Attitude towards trying and adopting new products and technologies.

- Health consciousness: Attitude towards health and wellness, affecting choices in food, exercise, and lifestyle.

- Social responsibility: Attitude towards supporting socially responsible brands and initiatives.

- Risk aversion: Attitude towards avoiding uncertainty and preferring safe choices.

- Value for money: Attitude towards seeking the best value in terms of quality and price.

- Luxury Orientation: Attitude towards luxury goods and a willingness to pay premium prices.

- Convenience Preference: Attitude towards prioritizing convenience in product or service choices.

- Digital Adoption: Attitude towards embracing digital technologies and online interactions.

- Status Consciousness: Attitude towards products or brands that convey a certain social status.

- Cultural Affinity: Attitude towards products reflecting cultural preferences and traditions.

- Social Media Engagement: Attitude towards active participation and engagement on social media platforms.

- Influenceability: Attitude towards being influenced by advertisements, peers, or social trends.

- Experience Seeking: Attitude towards seeking new and unique experiences in consumption.

#5 Lifestyle: that is, what consumers do, how they live, and the trends they have for life. More specifically, lifestyle is studied based on the study of (AIO) activities, interests and opinions. By category, the above dimensions are based on specific measurable data:

Activities:

- Work

- Hobbies

- Social events

- Vacations

- Entertainment

- Clubs

- Community

- Shopping

- Sports

Interests:

- Family

- Home

- Work

- Community

- Leisure

- Fashion

- Food

- Media

- Social networks

- Achievements

Opinions (for):

- Themselves

- Social issues

- Politics

- Business

- Finance

- Education

- Products

- Future

- Culture

- Technology

- Civilisation

This sequence follows a logical flow, starting with the underlying motivational factors (motives), progressing to the specific needs and desires, exploring personality traits, and finally, delving into the broader lifestyle aspects. It reflects a natural progression from internal motivations to external expressions, providing a comprehensive understanding of consumer psychographics.

IMPORTANT NOTE:

While there may be some overlap between psychographic and socioeconomic characteristics, they represent distinct dimensions of consumer segmentation. Socioeconomic characteristics typically focus on objective factors such as income, education, and occupation, while psychographics delve into subjective and psychological aspects like values, interests, and lifestyle.

Here’s a brief overview of the overlap and distinctions:

Overlapping Aspects:

- Activities and Lifestyle: While activities can be considered behavioural (psychographics), they also contribute to understanding the lifestyle, which encompasses broader patterns of behaviour, choices, and preferences.

- Interests: Interests align closely with lifestyle and can be influenced by psychological factors, making them a bridge between psychographic and socioeconomic characteristics.

Distinct Aspects:

- Personality Dimensions: Personality traits are distinctly psychographic, providing insights into individual differences in behaviour and decision-making.

- Opinions: Opinions, especially on social issues, politics, and culture, are more attitudinal and psychological, reflecting the subjective perspectives of individuals.

While there is some interconnectedness, the psychographic category generally goes beyond the external and observable socioeconomic factors. Psychographics delve into the why and how of consumer behaviour, offering a more holistic understanding of their motivations and preferences.

Combining psychographic and socioeconomic segmentation can create a comprehensive framework for developing targeted marketing strategies that resonate with the complex nature of consumer identities.

Behavioural characteristics: Behavioural segmentation focuses on how consumers interact with a product or service, and their behaviour provides insights into their purchasing patterns, usage frequency, brand loyalty, and other aspects. In the context of behavioural segmentation, some key components include:

- Volume Usage: This refers to how often or how much a consumer uses a product or service. It can involve assessing the frequency of purchases, consumption, or engagement. For example, consumers may be categorized as light users, moderate users, or heavy users based on the volume of their usage. By considering “Volume Usage” as part of behavioural characteristics, we can tailor our marketing strategies to different user segments. For instance, heavy users might respond well to loyalty programs or bulk purchase discounts, while light users may be targeted with initiatives to increase usage frequency. Analyzing volume usage within behavioural segmentation enables us to understand and respond to the diverse behaviours of our consumer base.

- Usage Habits: How consumers use products, how frequently, and in what context are behavioural aspects that impact future purchasing decisions.

- Purchasing Behavior & Preferences: This encompasses how consumers behave when making purchasing decisions and their preferences for certain products, brands, or features.

- Purchasing History: Examining past purchasing behaviour provides insights into trends, brand loyalty, and the factors that influenced previous buying decisions.

- Purchase Reasoning & Drivers: Understanding the reasons behind purchases and the drivers that influence decision-making sheds light on the motivations of consumers.

- Purchase Frequency: This aspect of behaviour looks at how often consumers make a purchase. It helps identify patterns such as frequent buyers, occasional buyers, or seasonal buyers.

- Types of Products: The choice of products, whether essential or luxury and the specific categories consumers engage with are behavioural indicators.

- Brand Loyalty and Advocacy: Loyalty to a particular brand is a behavioural characteristic that indicates the likelihood of a consumer repeatedly choosing a specific brand over others.

- Loyalty Status: Categorizing consumers based on their loyalty to a brand or product. This could include loyal customers, occasional buyers, and switchers.

- Factors of Perception: Understanding how consumers perceive a product, brand, or industry based on their experiences and interactions provides insights into their behaviour and decision-making.

- Preferences: Consumer preferences, especially in terms of features, flavours, designs, or variants, are behavioural indicators that influence their choices and usage.

- Price Sensitivity: This refers to how responsive consumers are to changes in the price of a product or service. Price-sensitive consumers may be more influenced by discounts, promotions, or changes in pricing strategies. Conversely, consumers with low price sensitivity may be less influenced by price fluctuations. Their behaviour may be driven more by other factors such as brand loyalty, perceived quality, or specific product features. Understanding price sensitivity helps in setting competitive and attractive pricing strategies for different segments.

- Usage Occasion: Refers to the specific situations, occasions, or events when consumers choose to use a product or service, highlighting the context-driven nature of their consumption patterns.

- Benefit Expectations or Intended Benefits of Use: Understanding the specific benefits consumers seek from the product. It falls under the broader umbrella of understanding how consumers interact with a product or service and the anticipated outcomes or benefits they expect from their usage. This aspect provides insights into the motivations and goals that drive consumer behaviour. By assessing benefit expectations, we can tailor our marketing strategies to meet or exceed these anticipated benefits, thereby enhancing consumer satisfaction and loyalty.

- Readiness Stage: Assessing consumers’ readiness to make a purchase, whether they are in the awareness, consideration, or decision stage.

- User Status: Distinguishing between first-time buyers, repeat buyers, and potential buyers.

- Media Consumption: The channels consumers use to consume information, whether through traditional media, social media, or other platforms, influence their behaviour.

- Brand Interactions: Understanding how consumers engage with and perceive a brand, including their attitudes toward advertising and promotional activities.

- Interactions with Apps/Websites/Businesses: Consumer interactions with digital platforms and businesses, online or offline, provide valuable data on preferences and engagement.

By incorporating behavioural segmentation, we can enhance our understanding of how consumers interact with the market dynamically. This approach allows us to tailor marketing strategies based on the specific behaviours and preferences exhibited by different consumer segments.

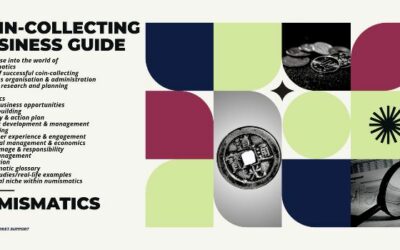

#2 Industrial Markets

Firmographics: Firmographics are to B2B markets what demographics are to consumer markets. Firmographics refer to the characteristics and attributes that describe businesses or organizations rather than individual consumers.

- End-use: How the product or service is ultimately used by the industrial customer.

- Market size: The size of the target market, often categorized by revenue or other relevant metrics.

- Product specifications: Detailed specifications and requirements for the product or service.

- Industry: The industry in which the business operates or intends to target.

- Standard Industrial Classification (SIC) Code: A system for classifying industries based on specific activities.

- Company Size: Categorizing customers (businesses) based on their size, whether in terms of revenue, number of employees, market share, etc.

- Purchasing Power: Purchasing power refers to the financial capability and resources of organizations to buy goods and services, influencing their buying decisions and consumption patterns.

- Customer structure: Understanding the organizational structure of the customer, such as hierarchy and decision-making processes.

- Psychographic characteristics: Similar to consumer markets, understanding the values, attitudes, and culture of the industrial customer.

- Geographical factors: The location and geographic concentration of industrial customers.

- Financial Stability: The financial health and stability of the business, are often assessed through financial statements and indicators.

- Customer Base: The types of customers the business serves and the diversity of its customer base.

- Service Specialisation: Niche or general services.

- Client Focus: B2B (business to business), B2C (business to consumer), B2G (business to government).

- Nature of services: professional services (consulting, legal, accounting), business services (marketing, IT, outsourcing), consumer services (healthcare, education, hospitality).

- Service Delivery Models: online, offline, hybrid.

- Customer Relationship Dynamics: long-term, project-based, and subscription-based services.

- Decision-Making Unit (DMU): The decision-making unit (DMU) or buying center comprises individuals within an organization, including the buyer, user, gatekeeper, influencer, and decider, who collectively participate in the purchasing decision process.

- Years in Operation: The length of time the business has been in operation.

- Strategic Goals: The business’s long-term objectives and strategic goals.

#3 Additional Criteria (Consumer & Industrial Markets)

Additional Criteria:

- Behavioural Loyalty: Loyalty that is exhibited through repeat purchases, long-term contracts, or consistent business relationships

- Technological Readiness: Assessing the technological readiness of customers, especially relevant in industries with rapidly evolving technologies.

- Regulatory Compliance: Considering the compliance requirements and regulatory environment that may affect customer needs.

- Risk Appetite: Assessing the level of risk tolerance among customers, especially important in B2B transactions.

- Innovation Adoption: Understanding how quickly and readily customers adopt new products, services, or technologies.

- Environmental Impact: Considering the environmental concerns and sustainability priorities of customers.

- Digital Readiness: Evaluating the level of digitalization and technology adoption among customers.

- Supply Chain Integration and Position: Assessing the degree of integration within the customer’s supply chain and the position of the business within the broader supply chain, including whether it is a supplier, manufacturer, or distributor.

- Customer Journey Stage: Recognizing where the customer is in their journey, from awareness to post-purchase engagement (see below, the “Symbiotic Odyssey” framework).

- Communication Preferences: Understanding how customers prefer to be communicated with, whether through traditional channels or digital platforms.

- Service Level Expectations: Assessing the expected level of service and support required by customers.

By considering these additional criteria, we can enhance the depth and specificity of our market segmentation strategies, tailoring our approaches to the unique characteristics and needs of our target audiences.

#4 Language (Consumer & Industrial Markets)

Language: The specific language, including keywords, idioms, and colloquial expressions that consumers use, can be a valuable criterion for market segmentation. This linguistic aspect is often referred to as “language preference” or “communication style,” and it can provide insights into the cultural and social context of different consumer segments. Here’s how it can be considered as a criterion:

- Cultural and Regional Preferences: Different regions and cultures may have distinct linguistic nuances. Understanding and using the language specific to a region or culture can be crucial for effective communication and resonating with the target audience.

- Generational Communication Styles: Different generations may use language differently. For example, millennials might use certain terms or expressions that are different from those used by baby boomers. Tailoring communication to the preferred language of specific generations can enhance engagement.

- Online and Digital Preferences: In the digital age, online platforms and social media have given rise to new language trends and expressions. Understanding the keywords and phrases commonly used in digital spaces can help in targeting audiences on these platforms.

- Industry-Specific Jargon: In B2B (business-to-business) markets, various industries often have their own set of jargon and technical terms. Adapting marketing language to align with the industry-specific language can enhance credibility and demonstrate industry expertise.

- Brand Affinity and Lifestyle Language: Certain brands and lifestyle choices are associated with specific linguistic styles. Identifying and incorporating the language that resonates with the target audience’s lifestyle and brand preferences can strengthen the brand-consumer connection.

- Emotional and Value-Driven Language: Consumers often respond to language that aligns with their emotions and values. Understanding the emotional triggers and values of different segments allows us to use language that deeply connects with our audience.

- Community and Niche Preferences: Within specific communities or niche markets, consumers may use language unique to their group. Recognizing and incorporating this language into marketing efforts can help establish a sense of community and authenticity.

- Consumer Reviews and Feedback Language: Analyzing the language consumers use in reviews and feedback provides valuable insights into their perceptions. This language can be leveraged to align marketing messages with consumer sentiments.

The concept of “language” doesn’t fit neatly into the categories previously discussed for market segmentation (e.g., demographic, psychographic, behavioural, etc.). Instead, it is a cross-cutting element that can influence and enhance various segmentation criteria. It can be considered as a dimension that overlays and interacts with other criteria, providing a nuanced understanding of consumer preferences and behaviour.

Understanding and utilizing the language preferences of different consumer segments is a nuanced way to tailor marketing communications. This criterion helps us not only speak the same language, literally and figuratively, as our audience but also fosters a sense of relatability and connection, which is essential for effective communication and engagement.

#5 Social, Interpersonal, and Situational Influences (Extra Layer) – (Consumer & Industrial Markets)

Social, Interpersonal, and Situational Influences:

- Social influences: These relate to the impact of social groups, family, friends, and society on an individual’s behaviour, values, and attitudes. This aligns closely with psychographic factors, as it involves understanding how an individual’s preferences and choices are influenced by their social environment.

- Interpersonal influences: This also falls within the realm of psychographics, specifically focusing on how personal relationships, social interactions, and communication patterns shape an individual’s behaviour and decision-making.

- Situational influences: While situational factors may not neatly fit into psychographics, they are often considered under behavioural segmentation. Situational influences include factors such as the physical environment, time constraints, and specific circumstances that can impact consumer behaviour.

In my segmentation framework, social influences align with psychographic characteristics, while situational influences could be considered under behavioural characteristics. Interpersonal influences may span both psychographic and behavioural aspects, as they involve both individual attitudes and behaviours shaped by social interactions.

Social Influences:

- Culture: The set of shared values, beliefs, and practices that characterize a group or society.

- Subculture: Distinctive groups within a culture that share common values, but also have unique characteristics.

- Individual Culture: Personal preferences and behaviours that may deviate from broader cultural or subcultural norms.

Interpersonal Influences:

- Groups: Collective entities with shared interests or characteristics, influencing individual behaviour.

- Social Classes: Divisions within a society based on socioeconomic status, impacting lifestyle and consumption patterns.

- Reference Groups: Groups to which individuals compare themselves and seek guidance or approval.

- Family: The primary social unit influencing an individual’s values, attitudes, and buying decisions.

- Opinion Leaders: Individuals with significant influence over others’ opinions and decisions.

Situational Influences: Situations: Specific circumstances or events that affect consumer behaviour. Belk suggests 5 groups of circumstance characteristics:

- Physical surroundings: geographic location, place, decoration, sounds, music, perfumes, lighting, weather conditions, placement of goods and things inside stores, etc.

- Social surroundings: persons present during the decision-making process by the consumer or during the purchase and use of the product, the characteristics of these people, their obvious roles, as well as their interpersonal interactions

- Temporal perspective: The temporal dimension is a dimension of occasions, which can be specified in units ranging in time from a certain time of day during which we consume a product, to an entire season within the year. Time can also be measured in relation to a past event or a future event, such as the time elapsed since the last purchase of the product

- Task definition: includes the intention or requirement to select, or purchase a product, or even to obtain information related to a general or specific product purchase. It may even reflect different expected buyer or user roles. For example, a consumer who buys a small household electrical appliance as a wedding gift for a friend is in a different situation than when he buys a similar appliance for personal use

- Antecedent states: They are momentary moods, such as intense anxiety, pleasure, aggression, or excitement. They can also be momentary situations, eg cash available for shopping, tiredness, and feeling unwell. In other words, these are situations that apply temporarily or momentarily and not permanent situations, such as the characteristics of the person, and which immediately precede the current behaviour of the consumer. They might be mood, issues, problems, and specific concerns.

Situations encompass a broader context that includes the immediate environment and specific events affecting behaviour.

Overlap Explanation:

Adding a dedicated category for social, interpersonal, and situational influences aligns with the complexity of consumer behaviour and contributes to a more holistic segmentation approach.

This extra layer encapsulates aspects of consumer behaviour that are shaped by external factors beyond individual characteristics. Here’s a brief explanation of the potential overlaps with other segmentation categories:

- Demographic: Social influences, such as family structures and cultural backgrounds, can impact demographic factors. For example, cultural values may influence preferences related to age or gender-specific products.

- Geographic: Situational influences can vary based on geographic location. Local customs, traditions, and environmental factors may impact consumer behaviour in specific regions.

- Socioeconomic: Social class is included in socioeconomic characteristics, but the extra category delves deeper into social and interpersonal aspects that contribute to socioeconomic status. For instance, social networks and group affiliations can influence purchasing decisions.