I can’t call myself a trader, most of an investor but I do trade from time to time. And when I do, I love it, even when I lose. Besides, this is the right mindset. If it hurts, don’t do it.

A few years ago, a friend informed me about Timothy Sykes and how an awesome trader and teacher he is, and I decided to try him out. So I chose a DVD training with the title…How to make millions, just because of the title.

But at that time, I was fully dedicated to expanding my marketing side of business, so I did not touch it until last year. I got excited but I was too busy to get involved.

Now, I’ve been through the most of it and here I am, reviewing it for you.

Timothy’s Background

He’s from a small town orange Connecticut and his family was middle class, not rich, not poor.

He was playing tennis and he wanted to go pro but he had a bad injury so he had to quit that dream.

In 1999 when the stock market was going crazy, his parents gave him control of the bar-mitzvah money knowing he was going to lose it all. They thought it would be a good lesson for Tim, to know the real value of a dollar.

But Tim did not lose it all, in fact, by the end of senior year of high school, he turned this money into $100,000, and by the end of freshman year, he reached a million dollars.

That’s why his father calls his injury, the million-dollar injury.

Timothy Sykes – How To Make Millions Review

The training is actually a presentation video with slides and Timothy talking over his computer, but it’s not boring at all. That’s what happens when you want to learn the secrets of making millions by trading, right?

Introduction

The beginning of the trading is a short story of Timothy’s accomplishments, but he does that in order to lure you into his world and adventurous spirit.

It’s all about the mindset.

As he says…

If you can’t visualize being a millionaire and truly believe it’s possible, chances are you won’t achieve millionaire status.

So damn true!

Don’t be someone that says I want to become a millionaire but it will never happen to me.

It’s not about happening…it’s about doing and being focused on your goals.

Timothy here tries to wake your dreams up and how to become obsessed about making money and eventually millions.

Here’s a quote I liked most…

Multi-millionaires understand the path to true wealth takes time, but you can’t get too comfortable along the way.

Other things I liked:

- You must utilize patterns and rules that have made other people successful

- Experts see things newbies and unsuccessful people don’t.

- 80-90%of traders lose and 96% of professional money managers fail to beat the major stock market indices.

- Making 15% to 30% per year does not create wealth anytime soon.

- Don’t think about companies and stocks as long-term investments, use stock prices only to increase your wealth quickly.

- My strategy is under the radar and ignored by Wall Street since it can only make you a few million dollars, not hundreds of millions or billions of dollars like all the smartest people want.

- We must control losses to stay disciplined and on the right path.

- Small losses help you develop discipline.

- Always getting better and refining.

He also gives you a vocabulary so you can follow along with the presentation.

Very good stuff.

He also analyzes the importance of not getting emotional and how to do that, and what kinds of orders you should use, and what types you should not.

He reveals that he only trades penny stocks and that this is his world and it’s personal. He explains why he is not using other kinds of stocks and the disadvantages of going for the stocks that the majority of traders choose.

He makes money mostly by understanding which companies are scams.

Going Deeper

Timothy discusses various terms of trading like volatility, liquidity, trading volume, and more.

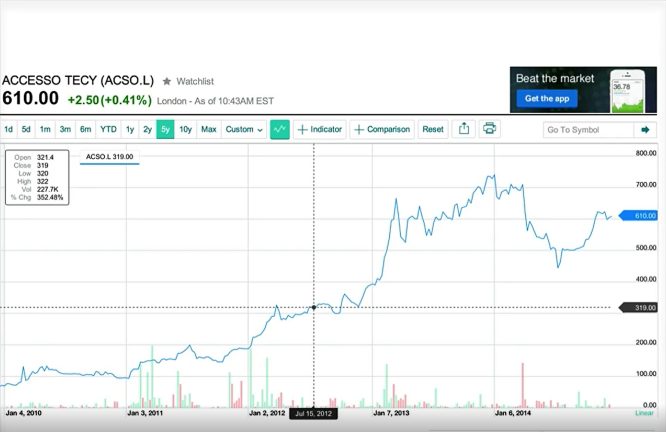

And he starts showing up examples of trades with numbers and data analyzing his strategies and point of view.

He highlights that the key is to discover patterns and key information that forces a stock to go up and down. The key is not being an expert in mathematics.

He then goes into analysing terms like afterhours price, last price, $ change, % change, day volume, open, 52-week high, 52-week low, last size, average trade size, # of trades, average daily volume, marketcap, pe ratio, eps, yield, dividend, ex dividend date, exchange, trade time, peg ratio, revenue growth, profit growth.

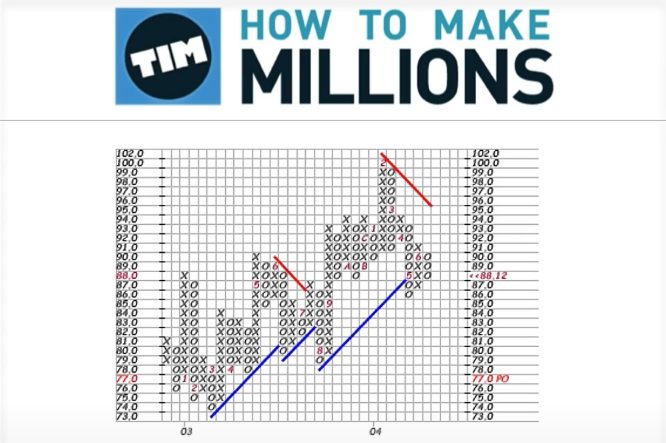

He discusses supply and demand, undersupply and oversupply, technical support and resistance, bullish – technical breakout, bearish – fakeout breakout, confirmed technical breakout, pullback and continue up, major breakdown, key levels, fakeout, shakeout, trends, channels, cup and handle, bullish – double bottom, bearish – double top, bearish – triple top, bearish – head and shoulders, bullish – ascending triangle, bearish – descending triangle, bullish or bearish – symmetrical triangle.

All the time he goes very deep analysing and explaining everything.

Timothy now explores Dow Jones industrial average, S&P 500, Nasdaq, Russell 2000, Wilshire 5000, gold, silver, oil, USDEUR, foreign markets. He clearly states that he’s not an expert in these areas and that he can’t help you in those markets.

Then he goes into discussing splits, reverse splits, biotech stocks, financial stocks, commodity stocks, REITs, SPACs, warrants, closed end funds, options, puts & calls. He is not trading that kind of stuff too.

He then shows you where to find the best stocks to trade, which websites to use for information, where to find the biggest % gainers daily across all US exchanges, and other similar listings.

He shows you stocks he focuses on, what gains scare the most people away, opportunity alerts, further gains, and more.

He explores market movers, various companies and stocks, most actives, gainers, losers, price, change, volume, 1-day.

Strategies

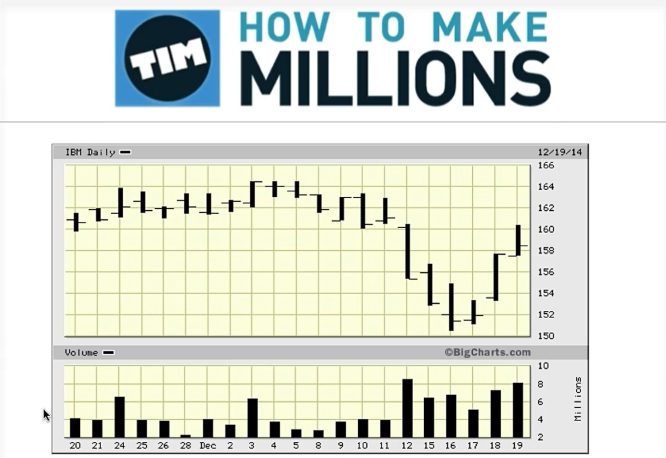

He begins with analyzing different types of charts, line charts, bar charts, candlestick charts, point and figure charts, high, low, open, close, advanced charting indicators, macd, rsi, Fibonacci levels, 200-day moving averages, crazy chart analysts, why he buys simple breakouts, what exactly he sells.

He then analyzes various articles and online discussions, key lessons from trades, contract announcements, run-ups, lqmt, simh, exact tops, the meat of the move, how to search for big % winners, what stocks not to chase, when to lock in profits, how to use leverage.

Examples of collapsed stocks, when he sells and buys, some crazy days, and more.

He discusses an article by Ellen Almer – ISCO to reap benefit from lawsuit, and how to take advantage of such news.

An article on CNET – 3D-printed exoskeleton helps paralyzed skier walk again by Daniel Terdiman.

He illustrates some examples of trading EKSO bionics hldgs com.

Review lessons from ekso and Cisco trades, penny stocks with good stories, exciting penny stocks stories with new technologies, how and when to read articles, watch TV and press,

What to do if hype does not push stock up, when to cut losses quickly.

Why Fridays are special, what to do on weekends, what newbies do, what veteran traders do.

What momentum does, solid profits, examples of ekso and isco, the right setup.

He shows what most traders do about holdings overnight and what he does.

Times of the day he buys and sells.

What he does the very next day of a particular trade.

The power of having specific plans and goals.

He shares stories of him losing even half a million dollars because he did not have a plan.

If you should ride the penny stock hype and if you should believe it.

Locking in profits, why you should not become a bagholder, what to do about muted follow-up spikes, what insiders do, the big initial spikes, short-cell candidates.

He discusses things like how to choose the right position size, how to plan, when to cut losses, when to take profits, how to create a solid trading plan for every trade.

Risk vs reward on every trade, his risk strategy, goals, what protects you from disaster.

How to grow a small account, how much % of your account you should be trading.

What is leverage, potential disasters, how and when to use leverage and when not to.

How to plan a trade, crazy plays, good old days.

He shows examples of his students’ trades, with numbers and data, he goes very deep.

More Strategies

Timothy now walks us through other advanced strategies and examples.

When stocks go further than we think and if we should risk more or not.

What to do when trading lower-priced stocks.

The power of discipline.

What happened in 2014.

When to spell out your potential risk and reward.

How to deal with every trade.

What happens if you deviate from your plan.

He also talks about cutting losses quickly vs cutting losses intelligently, hard stop losses vs mental stop losses, recognizing different risks and goals at different times of the day, schedule, and more.

Then he expands on losses and he analyzes various scenarios that have an impact on a trader’s personal life, consequences, and concerns.

He showcases an example of a company named Cygnus e-transactions group. They had launched an online ticketing technology solution for the redesigned SixFlags website which would enable SixFlags guests to more easily purchasing daily tickets, season passes and special event tickets for all domestic parks.

He then shows a notice by Steven K. Brown, president of Cygnus discussing Cygnus bankruptcy.

Timothy analyzes why Cygnus was his biggest loss but also the best teacher he ever had. And what decisions he made and how he would deal with every trade from that point on.

Hw shows what kind of stocks he is looking for when buying.

How he deals with stocks that are already moving.

How he stays alerted about new opportunities daily.

How he deals with latecomers, hot stocks on intraday breakouts, dips, and so much more.

The next session is all about beat estimates, missed estimates, guided up and down, conference calls, analysts, analysts upgrades and downgrades, analyst price target upward and downward revision.

How to guess earnings, reactions to earnings, positions in earnings stocks, management commentary, and more.

Final Review

This DVD training is a goldmine of information for people like me, who had no idea about penny stocks trading but want to start trading in these markets.

Penny stocks is a whole new world for me and for the majority of traders who believe that penny stocks is not an area with potential.

But Timothy showed me that penny stocks is actually the real deal.

Penny stocks are low priced stocks, stocks trading under $5 a share, and a lot of very sketchy and developmental companies that might have one or two products.

And penny stocks are very volatile, but that does not mean you will be profitable on every single trade. There’s a huge risk, of course, trading is a risky model anyway. But penny stocks hide an opportunity you should consider very seriously.

Penny stocks are not discussed on major media and publications, nor on TV, CNBC. Most people do not even know about them.

Timothy is using weird but very effective strategies to profit from penny stocks.

He analyzes historical data, he does not believe a word of what they say, he knows that most of them will eventually fail, but at the same time, momentum can push them up dramatically for a few hours or days.

His main philosophy is piggybacking moves that are already existing, trying to predict based on patterns in historical price action.

He’s not a broker nor a financial advisor, he’s just trying to find what patterns are working.

He clearly disclaims that most of the people lose money in penny stock trading, there’s a very negative stigma attached to it.

But if you can actually understand why they are moving, you will notice patterns that will give you directions on when to trade, for example.

Most penny stocks drop 50% in a day because of companies like the Wolf of Wall Street. When they start promoting them, they fall down.

But most people just see the stock drop. But if you look at the promotions, you will trace logical and predictable moves and patterns. People look at revenues, profits, earnings per share, but those indicators don’t matter with penny stocks.

Timothy is making money mostly by short-selling penny stocks, betting on stocks going lower. Because there are companies that are fundamentally worthless and when they are out $1 or $2 a share, usually they will drop 90%, and this is when Timothy is making a profit.

More importantly, Tim is not trading every day, he’s always waiting for something hot that’s moving.

Tim opened up a whole new world of opportunities for me and for wannabe traders all around the world.

I always believed that penny stocks is not a real deal, but now I think the exact opposite.

I started trading a little bit following Tim’s advice but with mixed results so far. But these results are great compared to the ones I got in the past.

That means Tim’s methods work.

I did not have the time to study a lot though. This is a huge training. From now on, I will be focusing on the training again, and start trading a little bit and will carefully monitor my results.

There’s a lot of work to be done, but if you want to become a millionaire trader, then you have to work hard and follow Tim’s rules and strategies.

Timothy is the real deal.

That’s it, another review has finished, here on Web Market Support. I am waiting for your comments and thoughts. Till next time.

Tasos Perte Tzortzis

Business Organisation & Administration, Marketing Consultant, Creator of the "7 Ideals" Methodology

Although doing traditional business offline since 1992, I fell in love with online marketing in late 2014 and have helped hundreds of brands sell more of their products and services. Founder of WebMarketSupport, Muvimag, Summer Dream.

Reading, arts, science, chess, coffee, tea, swimming, Audi, and family comes first.

0 Comments