In the past 3 years, the landscape of crypto has changed drastically. Thousands of new cryptocurrencies as well as exchanges are now part of the ever-growing industry that doesn’t seem to be slowing down.

If you were part of the industry just a few years back, you may remember that only a handful of exchanges were trustworthy options. Those platforms took the largest share of the trading volumes and were considered safe for the public to use.

Today, more than 300 exchanges are fighting for the top spots of CoinMarketCap (CMC) and many more are yet to be “officially” recognized.

With the growth of exchange platforms, what also seems to be growing are the daily reported trading volumes. Almost 100 of the previous exchanges are reporting daily trading volumes that exceed $50 million dollars. And from those, almost half are responsible for numbers larger than $1 billion.

One could argue that mainstream adoption has increased trading volumes massively. Others seem skeptical.

How can some exchanges trade more than a billion dollars per day when their Social Media channels are quiet and barely have any followers?

Fake Volumes In Cryptocurrency Markets

Bitwise findings

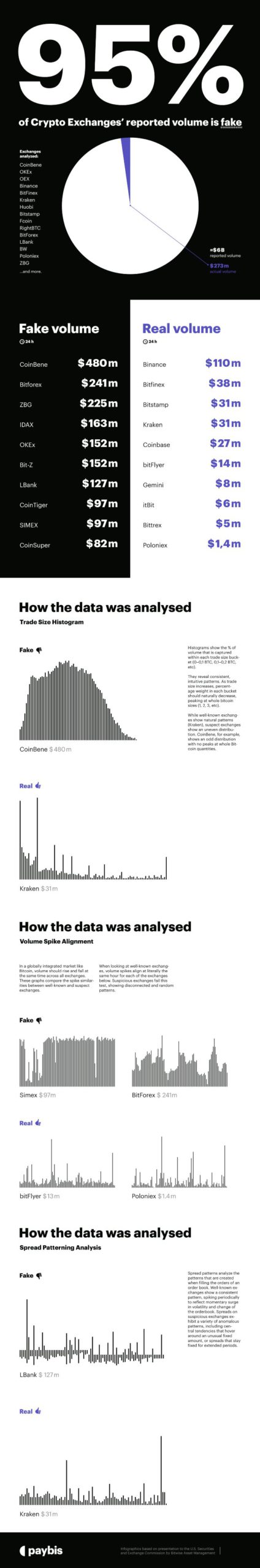

It was not until 2019 that Bitwise, an asset management group, performed in-depth research into the matter. In their report, which was presented to the U.S. Securities and Exchange Commission, they clearly outline the problem of inflated (fake) volumes in cryptocurrency exchanges.

That’s right. Apparently, the majority of exchanges are reporting artificially inflated trading volumes. The actual discrepancy is so high that only about 5% of reported volumes is matching the actual volumes of the platforms.

To make the findings easier to understand, Paybis prepared an infographic that shows how the data was collected and which platforms report truthful volumes.

Why do exchanges report artificially inflated volumes?

The report of Bitwise further analyses the findings to point out the reasons and motivations that lead to these unethical actions. More specifically, there are two reasons they emphasize on:

- Increased popularity – Exchanges that are listed on the top of CoinMarketCap’s exchange list receive more attention from the media and from new investors. This increases the platforms’ authority and makes them more popular in the crypto space.

- Growth in revenue – Popular cryptocurrency exchanges can charge higher listing fees for new coins, ICO’s, IEO’s, and other altcoins. The higher trading volume is an indicator of high liquidity which is helpful for new coins that need traction at their initial stages.

Short-term solution

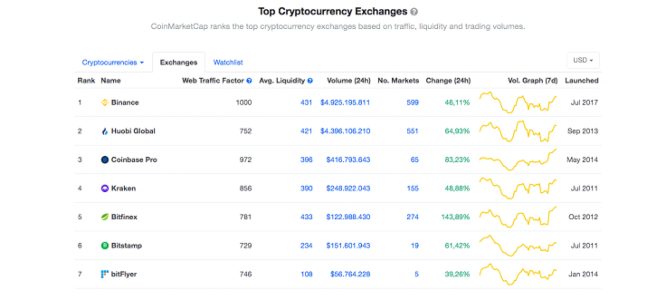

After Bitwise’s report caused an uproar in the industry, CMC’s Carylyne Chan verified and decided to work on the issue at hand. A few weeks after the findings, the platform introduced a new metric to help investors get a better understanding of the reliability of exchange platforms.

The liquidity metric allowed investors to filter different exchanges based on their actual liquidity instead of their reported trading volumes.

Over time, the “bearish” findings turned out to be the perfect fuel for further growth of the industry.

Binance acquisition

Earlier this year, rumors surrounding a potential acquisition started taking place. According to the sources, Binance was in discussion with CoinMarketCap, to potentially unite their powers in the name of progress.

A short while later, the news was announced – Binance acquired CMC for an undisclosed amount.

As soon as the deal was completed, an internal restructure followed. Brandon Chez, CMC’s founder, stepped down from his role as CEO and was replaced by former Chief Strategy Officer Carylyne Chan. The rest of the team (40) continues to work under the umbrella of Binance.

Binance’s founder, Changpeng Zhao, elaborated on the deal mentioning that both entities will continue to operate independently and that the acquisition would have no effect on Binance’s popularity in the platform.

But here’s where it gets interesting. As soon as Binance acquired CMC, the exchange list changed completely.

The platform introduced a new metric – the Web Traffic Factor. This metric is a combination of several social metrics to further illustrate the power of the platforms’ digital presence.

Rankings are now made based on both the web-traffic factor and all the other listed metrics. The only platform with a perfect score of 1000 is Binance.

This score may seem kind of unfair due to the acquisition. However, Binance is by all accounts the most popular exchange at the time of this writing.

A look into the future

As Bitcoin and other cryptocurrencies enter once again into the spotlight of mainstream media, the average investor is now smarter and more educated than before.

This, in turn, means that it will be much harder for exchange platforms to gain the trust of the public. Investors will now judge platforms and coins based on past events, and become much more critical and realistic in their decision-making process.

Unethical exchanges and irrelevant cryptocurrencies will slowly perish and be replaced by better, more transparent solutions. And with the improved data metrics of CoinMarketCap, it will be a lot easier to research and discover trustworthy platforms and promising cryptocurrencies.

While Bitcoin and other cryptocurrencies are still in their early stages of development, we have already witnessed major progress towards a more transparent and regulated market.

And we expect this trend to keep on growing.

Final thoughts

So, whether you want to buy or sell Bitcoin, make sure you choose an exchange that is reliable and only presents accurate trading volumes. By doing so, you help the industry reward the companies that are building towards a more decentralized future and not just more profit.

We hope you enjoyed this article. If any questions remain, feel free to leave a comment and let us know your thoughts.

Kelly

Cryptocurrency Journalist

Kelly is a Latvia-based cryptocurrency journalist with a passion for covering the latest happenings in the cryptocurrency and tech world. In addition to being the analytics specialist of Paybis, Kelly is also into consulting, reading, and investigative journalism.

0 Comments